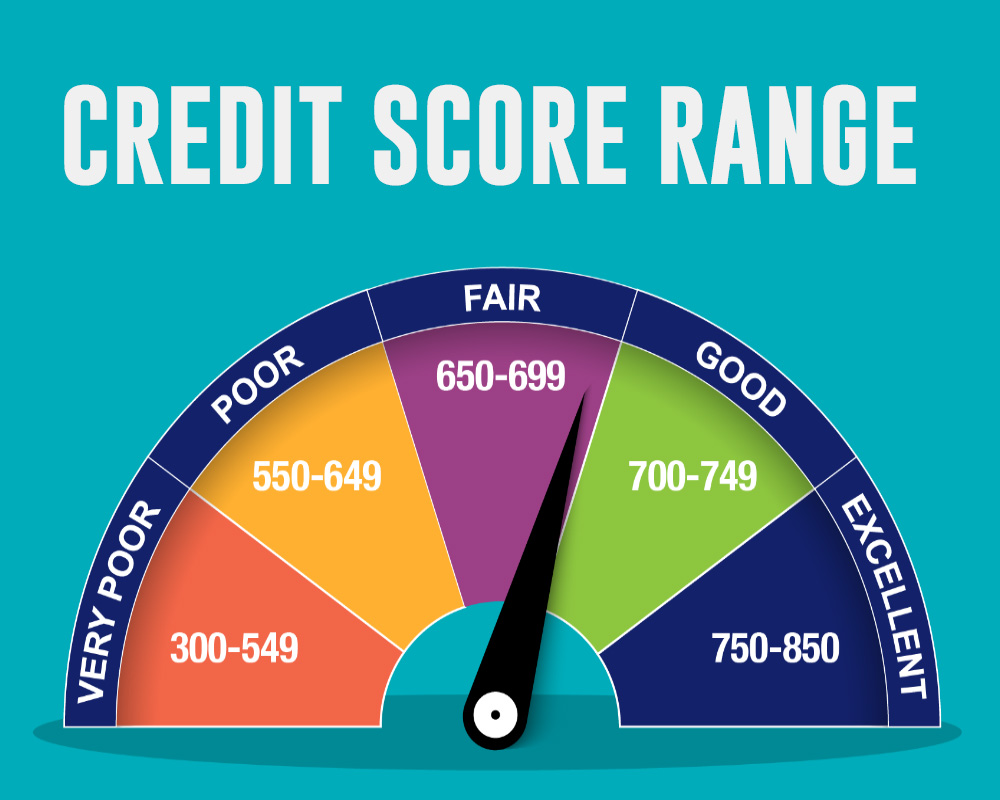

Scores can also be referred to as credit ratings, and sometimes as a FICO ® Score, created by Fair Isaac Corporation, and typically range from 300 to 850.įICO ® Scores are comprised of five components that have associated weights: Your credit score is a numerical representation of your credit report that represents your creditworthiness. If you spot an error, request a dispute form from the agency within 30 days of receiving your report. It’s a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. You’re also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate. You can request a free copy of your credit report from each of three major credit reporting agencies – Equifax ®, Experian ®, and TransUnion ® – once each year at or call toll-free 1-87. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. It includes your personal information and lists details on your past and current credit accounts. Your credit report provides a detailed summary of your credit history. What can lenders see on your credit report? When you apply for credit, lenders can legally request this document from one or more of the credit bureaus (Experian ®, Equifax ® and TransUnion ®) to assess how risky it is to lend to you. Your credit report tells potential lenders how responsible you’ve been with credit in the past.

0 kommentar(er)

0 kommentar(er)